...

More »

Purpose

Some onlookers have interpreted declining Average Sale Price in Apple Inc.'s (AAPL) major product categories to imply that Apple lacks pricing power, and must thus slide inevitably into a commodity market where its profit will collapse - so you must sell! This article reviews Apple's articulated pricing policy, and the results of that policy on unit sales, to examine the following question: Does Apple's pricing reflect the powerlessness implied by critics, or instead suggest that Apple is pursuing a pricing policy intended to protect its profitable position in the markets in which it competes?

First: A Common Sleight Of Hand

Sometimes, we hear that Apple has a product line (like iPods) with declining sales, or that is suffering cannibalization (say, to iPhones). Think about this for a moment. With more than half of iPods now iOS devices, it should be evident that Apple's phones (iOS devices just like the iPod Touch, but which make cellular calls) are also music players. "Losing" an iPod sale to a phone buyer is like "losing" a hambuger sale to a customer who instead orders steak.

Hint: you'd rather sell the steak. In 2007, Apple's CEO said of the iPhone:

It's three things: the best iPod we've ever made. An incredibly great cellphone -- we've really revolutionized how to use a cellphone. If it was nothing but a cellphone it'd be really successful. Third thing is it's the internet in your pocket for the first time.

Selling an iPhone to a former iPod buyer isn't properly called "cannibalization" but "upselling." Even when a new product placement causes genuine competition with a cheaper product, this can be a win for Apple. Multiprocessor iMacs certainly offer performance previously only available in a tower, for example - but the question isn't about the price of one unit sold to one buyer. The question is about the profit Apple can earn as a firm selling all the units the market will buy of a product category, under the pricing policy adopted by Apple. Sacrificing pawns for knights is good chess, and Apple has become a grandmaster.

Apple's Articulated Pricing Policy

On the occasion of the Macintosh's 20th anniversary, Steven Levy interviewed Apple's CEO in 2004 and recounted the following explanation for the Mac's (then, but not now) single-digit market share in the U.S.:

[W]hy is the Mac market share, even after Apple's recent revival, sputtering at a measly 5 percent? Jobs has a theory about that, too. Once a company devises a great product, he says, it has a monopoly in that realm, and concentrates less on innovation than protecting its turf. "The Mac-user interface was a 10-year monopoly," says Jobs. "Who ended up running the company? Sales guys. At the critical juncture in the late '80s, when they should have gone for market share, they went for profits. They made obscene profits for several years. And their products became mediocre. And then their monopoly ended with Windows 95. They behaved like a monopoly, and it came back to bite them, which always happens."

A wicked smile cracks the bearded, crinkly Steve Jobs's visage, and for a moment he could be the playful upstart who shocked the world 20 years ago. "Hmm, look who's running Microsoft now," he says, referring to former Procter & Gamble marketer Steve Ballmer. "A sales guy!" The smile gets broader. "I wonder ..." he says.

(As indicated in a 2009 article, Ballmer's own predictions about Apple have been entertaining in light of subsequent events.)

Acknowledging Apple's long-time reputation of charging a lot for a product unit, Apple's recent leadership has scorned pricing products at the highest price they will sell. Case in point: less than a quarter after releasing the original iPhone, Apple - which had no trouble selling them - cut their retail price by $100 $200 each ($100 was the rebate coupon it gave earlier buyers). Although the price cut generated complaints and a lawsuit, the effect was positive: Apple was expressly not trying to maximize per-unit profits, but was re-aligning its strategy to maximize corporate profits.

Since profits are the product of per-unit profit and the number of units, it follows that one can increase profit by increasing either. As it happens, though, product pricing impacts the public's appetite for purchase: moving either number moves the other. Maximizing organizational profit involves maximizing not one or the other, but the product of their multiplication. So being able to sell one of these babies might yield an outstanding Average Sales Price, but pretty mediocre enterprise profit (especially considering the scale of the resources going into the device's design and regulatory compliance and the startup costs peculiar to the manufacturing of the specific model). On the other hand, selling tens of millions of these babies - bearing a vastly lower Average Sales Price - is currently able to support the highest corporate profits in the global cellular industry.

But, Wait! There's More! Apple's current CEO made it clear back in 2009 that Apple's pricing policy included a specific competitive objective:

On Wednesday, Cook echoed Jobs' comments about iPhone pricing by saying "one thing we'll make sure is that we don't leave a price umbrella for people." A price umbrella is a term used to describe the effect a dominant company can have on a particular market with a popular-yet-expensive product: competitors can enter the market with other products at lower prices and gain customers just based on affordability, buying those companies time and profits to use in order to make their product better.

The price umbrella that would be created by selling only at the highest possible price points would allow competitors a freedom to seize market - and breathing room - in which to profit and to stage attacks against higher-profit market segments. Apple's experience with the iPod proved that if Apple priced products across the competitive spectrum, it could earn profits it did not need to yield to others.

Competing with a broader range of ASPs means competitors have to compete on quality and price across a much larger range. By denying safe haven to competitors in low-priced niches, Apple seized (at 82% in 2004) and kept more of the music-player business than the entire rest of the mobile music player vendors in the world combined. By denying safe haven to PC vendors for portable devices under $1,000, Apple has sold so many iPads that - if iPads are counted - the former niche-player is now one of the top two PC vendors on the planet. Apple's strategy for the smartphone market has made it the most profitable cell phone vendor on the planet. And what was that winning strategy? A hint: it wasn't charging the highest possible retail price for every product it sold...

Instead, the strategy was to leave no price point uncontested.

Apple's Product Pricing Strategy: Actual Results

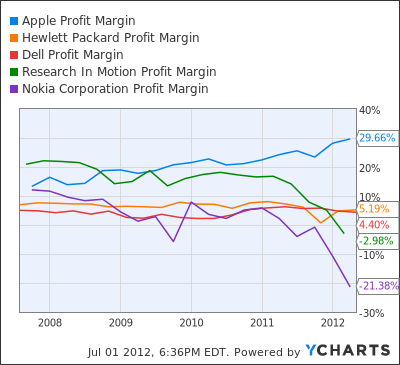

So, does the Apple's long-term trend show its margins being clobbered by commodity pricing? Have a look:

Research In Motion (RIMM), once a margins leader, is now scrambling for profit. Nokia (NOK), once a successful commodity vendor, now has negative margins. Dell (DELL), which has been driven out of phones and tablets in the past and now seeks to profit by positioning itself as a full-service business solutions provider because it has not been able to maintain profit growth as a hardware vendor. Hewlett-Packard (HPQ) has eclipsed Apple in unit volume, but with single-digit profit margins, cannot approach Apple's profits.

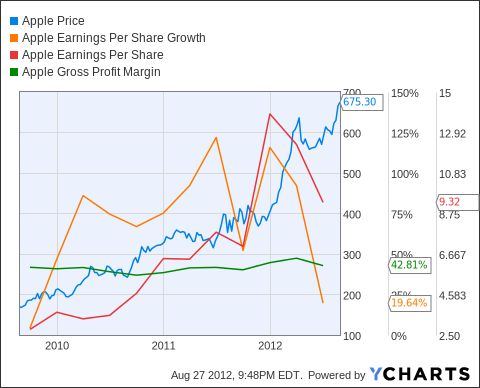

Does the current competitive environment really harm Apple? Although the following chart (exploited in this article to justify fear of Apple shares) has some scary-looking downward slopes on the earnings and earnings growth lines, that's not the real fright. The real fright is in how easy it is to fool yourself when you don't read carefully. Pay careful attention to the Y-axis labels before deciding the company is in a death spiral: (hint: read over to the orange number on the percentage axis, which is the Y-axis in the middle of the three Y-axes presented on the chart)

After the steep decline depicted in the chart, Apple's has declined to "only" 19.64% earnings per share growth. If a reader has another investment with as solid a financial position, and 19.64% earnings growth, please share in the comments - we're all hunting for a good investment. That Apple's quarterly growth numbers' should decline from over 100% can't have been a surprise, however steep that graph looks at first blush. The real question is whether the current growth is acceptable, and whether the company's prospects support future growth that is acceptable.

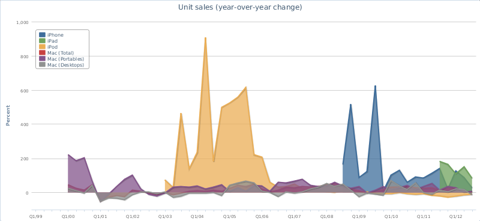

The real story in Apple's metrics is its consistently high margins and its consistent unit growth. The following chart, generated at Barefugure.es from Apple and Wolfram Alpha data, shows Y/Y growth (in units) across all Apple's major segments:

Although there have historically been quarters in which Macs had negative growth from their comparable quarters' sales, this has not occurred in years: Mac growth has beat the market for 25 consecutive quarters now. The present negative growth in iPods is vastly offset by the growth in the iPhone line into which those customers are being upsold. The iPad is currently in a high-growth phase, which is interesting because the newest model was released in China so recently its sales numbers in China have never been included in a quarterly report. As reflected in the immediately previous link, Apple experienced 100% year-over-year growth in that market in the last-reported quarter, despite the lateness of the new iPad. Expect Apple's sales in its China market segment to exceed those in the United States within a year, and for sales numbers to reflect this.

Conclusion

The graph of Apple's consistently high profit margins, combined with its strong and improving unit sales, explain Apple's high earnings. The comparable-quarter unit growth explains the double-digit earnings growth reported last quarter. These factors provide an appropriate basis for analyzing upcoming quarters. Based on recently reported trends in unit sales of Macs, iPhones, and especially iPads, Apple's profit growth should be expected to remain acceptable and to grow even in the absence of Apple's entry into a new product segment. At China's current market size for Apple, the company's existing growth in that market has the potential to fuel double-digit earnings growth at Apple over the next year even if the remainder of the global market is flat.

Apple's pricing policy is not designed to maximize the average sales price of a particular product, but to maximize the enterprise earnings of Apple as a firm. The source of Apple's production efficiencies (and thus its high margins at similar price points) is a matter for another article. This article addresses only Apple's pricing, and whether it reflects failure or success.

Apple's pricing does not reflect a failure such as declining brand strength, but is a deliberate effort to compete over time at more price points so that competitors have fewer and fewer places to earn uncontested profits that can be used to attack markets of critical import to Apple. ASP is therefore not an appropriate gauge of Apple's success in being able to price its products as it sees fit. Rather, the quarter-by-quarter ASP reflects a single part of Apple's larger and long-term strategy to maintain a high product of (Unit Profit) x (Unit Volume) in its major product segments.

Apple's pricing results from a reasoned and deliberate strategic decision regarding Apple's competitive landscape and its competitors. Apple's pricing has helped Apple address a much larger market than Apple had been able to address under prior ('90s) management. Apple's ability to enjoy its impressive margins while offering such a wide range of pricing is evidence of great success at Apple and does not evidence deterioration of Apple as a competitor in the electronics industry. Apple's pricing policy poises it to profit.

Disclosure: I am long AAPL. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

...

More »

No comments:

Post a Comment